In recent years, the medtech industry in the Asia-Pacific (APAC)* region has been greatly affected by a rapidly changing socioeconomic environment, geopolitical tension and healthcare worker shortages. What do companies need to know to successfully navigate the changing medtech landscape? To cut through the noise, we spoke with several medtech business leaders and identified several key trends shaping the APAC medtech industry:

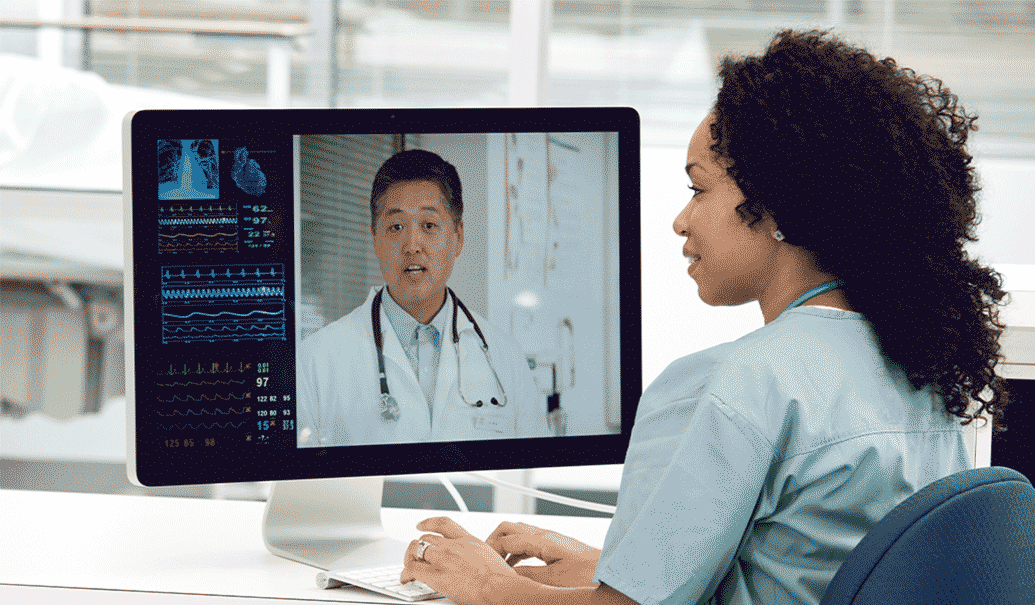

Connected care is growing rapidly in APAC with digital technologies in medical settings

Healthcare providers in APAC are increasingly adopting digital technologies, including AI and cloud technologies, in their standards of care. This is unsurprising, as the benefits to connected care are many. For example, certain diseases are now treated earlier than before with remote monitoring technologies. We are seeing health systems such as Vietnam’s Hoan My Sai Gon Hospital adopting AI tools for chest X-rays and CT brain scans to facilitate early disease detection. There also is a growing affinity toward cloud adoption among health systems. Health providers such as Singapore’s IHiS are looking to adopt cloud technology to realize interoperability in public healthcare ecosystems. As such, care teams between different departments and hospitals are now more connected than ever, leading to reduced treatment delays and improved care.

“Continued innovation and capability-building will thus be critical for medtech companies to emerge as market leaders, defining the future of the industry in the APAC region.”

Care delivery is shifting from in-patient settings to day surgery and home care

With rapidly aging populations and shrinking workforces in APAC, the increase in healthcare costs is inevitable. To control ballooning costs, healthcare systems are lowering the number or duration of hospital stays through day hospitals, home care and telemedicine. This phenomenon is particularly evident in mature APAC markets, notably Australia and Singapore. In Australia, the number of day hospitals has grown by 12% from 2014 to 2019, with a total of 357 private stand-alone day hospitals. An expanding array of services is also now accessible in day hospitals, such as kidney dialysis, hernia repair and laparoscopy.

Separately, in Singapore, home care programs are being built to free up hospital resources, reduce costs and improve care delivery. For example, in 2021, Singapore startup Speedoc, a home medical services provider, partnered with the National University Health System to create virtual wards, saving more than 15,000 bed days in less than 18 months.

APAC markets are moving toward prevention and personalized care

To contain increasing healthcare costs, several APAC countries are providing incentives for health screening to improve the rate of early disease detection and treatment. For example, to mitigate affordability issues, the Malaysian government last year began providing free screenings for lower-income groups under the Peka B40 program.

Another way in which healthcare costs can be reduced is by targeting cancer, one of the leading causes of health burden in the region. We are seeing an uptick of APAC health systems using precision diagnostics and treatments, as well as personalized treatments, against cancer. This has been enabled by leveraging digital technologies such as genomic technologies and advanced digital imaging.

Surgical robotics will expand in response to an aging society and workforce shortages

With a shortage of healthcare workers in APAC and advancements in technology, more attention is being placed on robotics and automated systems to reduce burden on the healthcare system. Strong government support is increasingly seen across APAC, with many robotic-assisted surgeries now publicly insured in markets such as Japan, South Korea and Taiwan. In addition to surgeries, APAC countries such as Indonesia and South Korea also are investing in building infrastructure for surgical robots. It is expected that the APAC surgical robots market size will reach $3.4 billion in 2028, growing at a compound annual growth rate of 11%.

Government regulations are evolving to adapt to the increasing cybersecurity risks

The use of digital technology comes with data risks. To mitigate them, governments, including those in APAC, are tightening data governance regulating cybersecurity, data privacy and data residency. In 2022, the government of India proposed a new data privacy law to mandate how companies handle data, including permitting cross-border data transfer with certain nations. Additionally, their cybersecurity requirements for medical devices are increasing. To better prevent cyberattacks, Japan issued a new guidebook in 2022 on medical device cybersecurity based on international standards.

Global supply chain disruption has encouraged medtech to diversify supply chains

The COVID-19 pandemic and geopolitical tensions caused significant disruption in global supply chains that affected the medtech industry and exposed key vulnerabilities. Medtech companies are now bolstering their supply chain resilience by onshoring or near-shoring their central (Node 1) warehouses to key APAC markets. For example, Boston Scientific opened a global distribution center in Malaysia last year, its first in Asia. This center acts as a distribution hub for APAC markets and is key to strengthening Boston Scientific’s supply chain resilience.

Medtech companies also are exploring production outside of China to address the increased labor cost and mitigate various risks associated with operating from China. Together with attractive manufacturing incentives rolled out by various governments in Southeast Asia, companies are increasingly looking toward the region for production. This was seen with Smith & Nephew, which last year invested more than $100 million in a new manufacturing site in Malaysia to support its growing APAC orthopedics business.

How medtech can navigate these industry trends to secure APAC success

As the medtech industry continues to evolve in APAC, medtech companies have a great opportunity to shape the market. With varying government priorities and incentives for medtech across APAC, it will be important for medtech companies to work closely with policymakers, payers and regulators to ensure their products not only address the unmet needs but also help achieve the long-term access and development goals of their key markets. Continued innovation, partnerships with other medtech companies and start-ups and capability-building will thus be critical for medtech companies to emerge as market leaders, defining the future of the industry in the APAC region.

*Asia-Pacific markets excluding China

Add insights to your inbox

We’ll send you content you’ll want to read – and put to use.