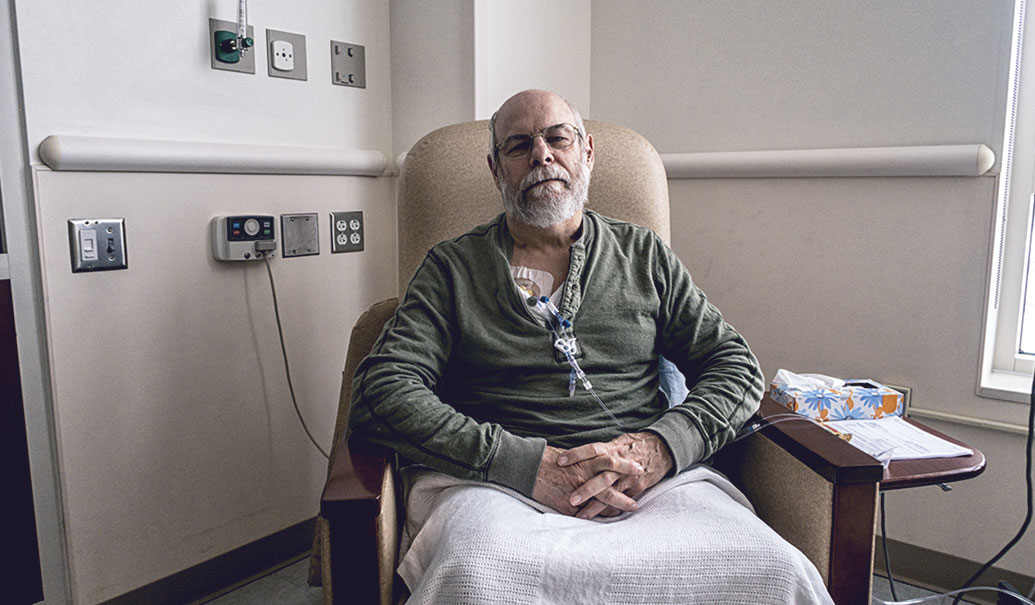

COVID-19 is posing a threat to the community oncology business model, but it’s also creating a case for the practices to play an elevated role in the oncology care continuum. While hospitals focus on managing patients with COVID-19, community oncology practices have become the “safer zone” for cancer patients to continue their care—often closer to home and at a lower cost. These themes were front and center at the 2020 Community Oncology Conference, held virtually by Community Oncology Alliance (COA) in April. Following the event, we gathered the perspectives of two community oncology leaders: Jeffrey Patton, MD, CEO at OneOncology and executive chairman of the board at Tennessee Oncology, and Jeffrey Vacirca, MD, FACP, CEO and managing partner at New York Cancer & Blood Specialists and board member at OneOncology. As markets begin to reopen and new COVID-19 hot spots potentially emerge, we need to consider how community oncology practices have been affected and determine how manufacturers can adjust their approach to support cancer patients and oncologists moving forward.

Community oncology practices are facing challenges that place patient well-being at risk

New oncology patients are going undiagnosed for prolonged periods and experiencing treatment initiation delays. Those already on regimens—especially patients who are immunocompromised—are facing disruptions to where they receive care, and other challenges in maintaining continuity of treatment. In fact, some oncology providers, particularly community oncology clinics, are experiencing a significant decrease in “foot traffic.” According to practice activity data compiled by ASCO, there was a 40% decrease in total visit activity across 16 oncology practices in March 2020. ZS research and financial modeling suggests that even a small decline in patient volume can significantly affect the financial stability of these practices. Furthermore, the impact may be the greatest on small providers, where a 10% decline in patient volume through a single quarter can make operations unsustainable. Larger community practices aren’t immune: We found that even a 20% decline in patient volumes can significantly affect their financial viability.

ZS research has found that across community oncology clinics, drug costs may represent up to 65% of a practice’s total expenses and contribute up to 70% to the practice’s top-line revenue. To offset declining patient volumes, CMS has temporarily suspended the 2% sequestration payment reduction on Medicare claims, which will increase Medicare drug reimbursement premiums from 4.3% to 6% of a drug’s average sales price (ASP). In addition, community oncology practices also face short-term cash flow challenges, with likely delays in claims processing and payments from payers as they adjust to a remote workforce and prioritize COVID-19-related activities.

While CMS’s recent rule that expands accelerated payments to providers will help mitigate short-term cash flow issues, the steps taken so far likely aren’t enough to mitigate the financial stress on community oncology. To navigate through the COVID-19 pandemic, many oncology practices may need to make structural reductions in operational expenses to stay afloat. We also may see accelerated practice consolidation and an increased need to form alliances and partnerships with cancer networks like One Oncology or GPO-driven alliances like the US Oncology Network.

As practices make structural changes and decisions with long-term implications, we expect finances to become a more important driver in decision-making and to increase oncology management in the community setting. As Dr. Patton mentioned in his interview, when efficacy and quality of life are comparable, the focus shifts to the economic benefit. With more crowding of tumors with therapies that have similar outcomes, we expect the need for managing the class to increase further. During the COA conference, Debra Pratt, MD, executive VP at Texas Oncology, referenced an example where inclusion of the pathway and a “clinical nudge” in the EMR increased target compliance from 58% to 72%.

According to recent ZS research, 64% of organized oncology providers have already adopted a cancer treatment pathway. And, community oncology leaders anticipate both greater prevalence of pathways and more specificity within these pathways to guide patient-specific therapy treatment decisions.

Beyond the financial burden and likely future consolidation in some markets, especially around the COVID-19 hot spots, community oncology practices are taking on a different role in managing the cancer continuum. While large cancer centers like Memorial Sloan Kettering have taken significant steps to convert some floors into COVID-19 wards, community oncology practices have been coordinating through alliances with these cancer centers and have taken in patients, changing the role they play and questioning the historic shift of cancer care toward large hospital settings. To manage COVID-19 demands, for example, New York Cancer & Blood Specialists seamlessly supported patients that migrated to their infusion centers from their partners at Stony Brook Cancer Center and Mount Sinai Hospital. The COVID-19 tragedy is making systems come together and work together in a unique way.

The leaders we spoke with at COA suggested that COVID-19 could be a wake-up call to hospitals, as they may be forced to “get back to basics” enabling community oncology practices to play a larger role in delivering cancer care at a local level.

What can manufacturers do?

To support the oncology ecosystem—especially community oncology practitioners—during this time, manufacturers should start by understanding how drug revenues fit into the practice financials. Based on that information, pharma companies can tailor strategies to suit individual practice needs and brand objectives. The shift in the role of community oncology in COVID-19 hot spots warrants a more agile local healthcare market approach to customer engagement strategy and a reassessment of the traditional prioritized solutions that manufacturers take to these customers.

1. Better understand how drug financials fit into the practice financials: Manufacturers can assess and model how their products and services influence the broader financials of oncology practices, including both the revenue and cash flow impact. It will be important to consider how their impact may vary across practice sizes, given the meaningful differences in operations and sources of incomes across small, medium and large practices. In addition, the impact on practices is not uniform just as COVID-19 impact is not uniform across the nation and continues to fluctuate from week to week. Manufacturers can scenario plan around these dynamics and assess the impact community oncology clinics are facing and will face in the future.

2. Execute a range of strategies to mitigate financial burden: Given the complexity and magnitude of changes COVID-19 is leading to, it’s unlikely that a single approach will be enough. A range of strategies executed in cohesion by manufacturers to support both community oncology and their patients can deliver the type of impact needed. Supporting providers with programs that extend payment terms for drugs and simpler return policies can alleviate short-term cash flow challenges, adjusting contracts in the short-term can offer relief on revenues needed to pay the bills and enhancing patient support services can increase practice revenues by getting and keeping patients on therapy.

In particular, any programs tailored to alleviate financial stress should consider how small practices are supported, given they may be at a larger risk of insolvency. ZS modelling suggests that even a 3% increase in contract terms to providers on their drug spend can offset a 10% decline in patient volumes for small practices, thereby providing critical short-term support to keep their doors open. However, any such concessions would have negative implications on drug ASP and therefore on long-term reimbursement, though it may be feasible to request a waiver from CMS given the unprecedented times. Beyond providing direct financial help to practices, it’ll be critical to reinforce services that provide drug authorization and financial assistance to patients—especially those who are unemployed—to ensure that those in need are able to receive the appropriate care.

3. Take a holistic, agile and local market approach: As community oncology clinics and large hospital systems become more interconnected, managing business needs and allocating resources at a more local level becomes critical. Planning an engagement strategy that is locally driven will help manufacturers ensure that they’re setting themselves up to better serve patients. Specifically, manufacturers need to:

- Understand and map the shift in care delivery, especially in the COVID-19 hot spots. Identifying and supporting new or alternate sites of care is the first step in developing a new strategy for maintaining the continuum of care.

- Prioritize customers and accounts that previously may have not been top tier, given their increased importance in the local ecosystem.

- Engage with customers across the care continuum and leverage centralized infrastructure through the oncology networks to drive support and engagement.

- Ensure the right information and value proposition is established to gain the appropriate position in increasingly prevalent and precise pathways.

- Enhance KAM capabilities, and move from a key account to a local healthcare market mindset, engaging customers across the new continuum of care.

In recent months, drug manufacturers have stepped up with several programs to support patients and community oncology providers, and their efforts are making an impact. As we get into the next phase of the COVID-19 pandemic, and prepare for the uncertainty that will follow, there’s room to better understand the situation as it evolves dynamically and for pharma to identify innovative ways to address challenges facing stakeholders across the healthcare space.